Owning real estate is a path to wealth. Large corporations and capitals started with a “For Rent” sign hanging in the window of a small house. Being a landlord is a demanding job. It is necessary to deal with dozens of small and large details every day to be successful.

Preparing to become a landlord has several aspects. First, the new landlord must understand federal and state laws. You can get such information at various places, such as the Oregon Bar, the state Attorney General’s Office, The Oregon government website, and the public library or online.

Also, there are city and county housing codes, which set the rules for providing safe and sanitary housing, whether public or private.

The measurements taken by the CDC, the federal and state governments to protect the population from the COVID-19 hardship have produced a severe economic impact that has been slapping individuals, businesses, and the Americans’ peace of mind.

Housing laws in Oregon protect tenants from eviction at least up to December 31, 2020.

So far, the government office has not issued an extension on the eviction moratorium rule, but it is most likely governor Brown will sign an executive order to extend it.

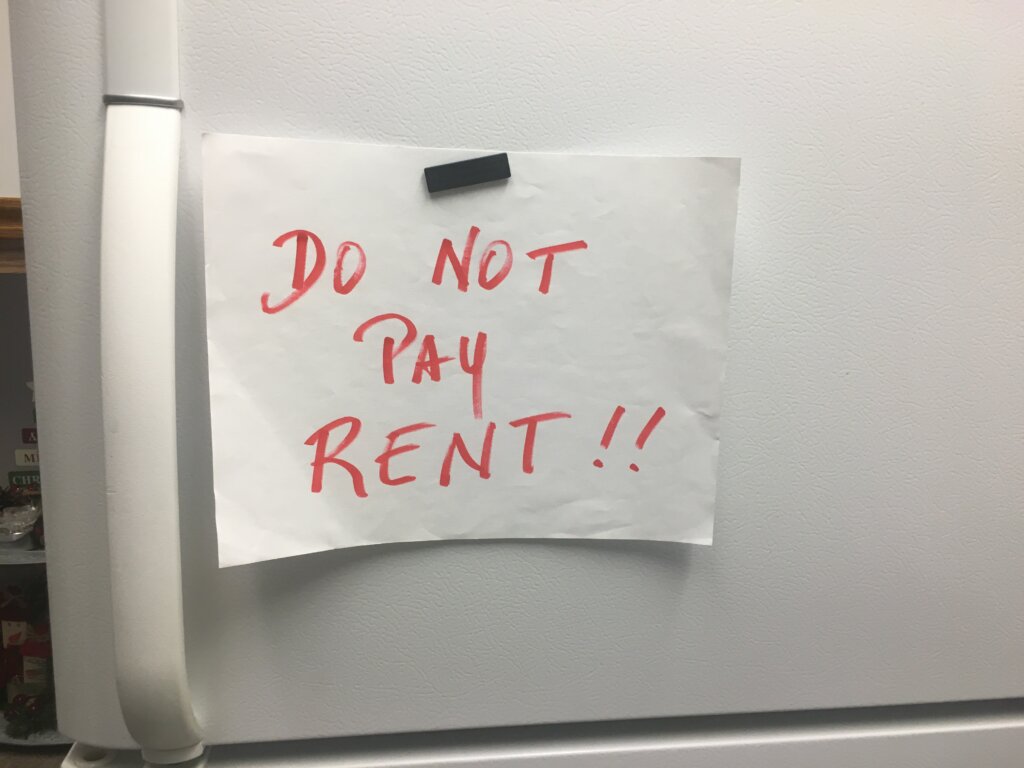

As a consequence of the virus prevention rule, Mom-pop, and small landlords are simply bystanders with no power to regain control of their rental properties when a tenant is unable to pay the rent. Tenants financially affected by the Coronavirus pandemic are authorized by law not to pay rent as of April 2020. On the other hand, there are small landlords with no income from their rental properties but with obligations to meet, such as property taxes, maintenance, and mortgages. Some of them have also lost their jobs or other sources of income because of the pandemic.

The Mortgage Forbearance Syndrome.

Homeowners financially affected by the coronavirus hardship with mortgages covered by the CARES Act are entailed to an initial 180 days mortgage forbearance. In addition, they can request another 180 days forbearance extension if it is needed.

Homeowners financially impacted by COVID-19 without federally backed home loans should contact their lenders for help. The problem many of them find is that only a handful of lenders are willing to work with homeowners. According to our clients’ testimonials, the majority of banks have rejected mortgage forbearance applicants without a reasonable explanation, putting them at risk of foreclosure.

Some lenders grant a 90 days forbearance plan to conventional loan homeowners, but at the end of the forbearance period, they are disqualified for an extension, again, without explanation.

The options for these non-federal-backed desperate homeowners and small landlords are either a foreclosure path or selling the property.

Every day in our Better Off Home Buyers offices, we receive emails and phone calls from single-family homeowners and small landlords, asking if we purchase their properties. The tremendous impact on the economy has been devastated during the last half of 2020. It is necessary to point out the struggle small landlords face during the pandemic. At the time we are writing this post, dozens of small landlords are not collecting a single penny from their rental properties for the last seven months.

If an effective vaccine to eradicate the virus is not coming out before April or May 2021, and the number of unemployed does not decrease. Small landlords can face foreclosure and losing their property.

360 days mortgage forbearance won’t save homeowners and small landlords from disaster. Even after COVID-19, many will need way more time to get back on track.

Some Landlords Screwed Up By Their Tenants.

The temporary moratorium on residential evictions for non-payment protects renters in Oregon.

Governor’s Executive Order 20-56 prevents tenants from being evicted during the time set by the order. Although the move is intended to prevent the spread of the coronavirus, many tenants seized it for profit. Some landlords have informed us that their tenants falsely claim they were unemployed or on furlough.

Experts believe, when the executive order comes to its end, tenants that are not making rental payments will move away. The frame time to resume rent payments and to start paying back the missed months is between January first to March 31, 2021. This critical economic situation makes us predict people will not pay their rent, even if they make enough money for it. Struggling landlords will be their lender’s prey unless they encourage themselves to take measures to improve their situation.

An independent landlord contacted us saying he owned a single-family rental house in Portland. A month after the coronavirus broke out, his tenant called him to notify he was affected by the pandemic. He had lost his job, and it was impossible for the time to pay rent. Our client was renting his property for $ 1850 monthly. By November 2021, his tenant had an unpaid rent balance of $ 12,950.

This landlord worried that by January first, 2021, his tenant would be in the same economic situation and obviously not able to resume the rent payments plus the owed amount. However, if Governor Brown does not extend the moratorium, evicting the tenant would take another four months. In other words, it all will be 12 months without collecting the rent payments, a total of $22,200.

Using this landlord problem as an example, we calculated the total our customer may loss up to May 2021, as follows:

12 months rent X $1850 $ 22,200

Eviction process $ 800

Property taxes $ 2,500

Home repairs (assuming light damages) $ 8,500

Waiting time for new tenant (2 months) $ 3,700

————-

Total loss $ 37,700

=======

Our client (we don’t have his permission to use his name) manifested his intentions of selling his rental property to us. He had inherited the property eight years ago.

His tenants were occupying the house for two years. Only on a couple of occasions, they paid the rent a few days late. He told us that for this time he was convinced his tenant was taking advantage of how generous Oregon law favored tenants.

With a Mortgage Forbearance Plan.

Requesting a mortgage forbearance plan for a rental property loan differs from a residential one. A rental house is an investment. Since getting a forbearance plan for your home loan, you just need to say you are struggling because of the pandemic. Otherwise, to obtain mortgage forbearance on the rental house, you must submit an application supported by documents. Banks will take their time to approve the request or reject it.

In general, private lenders approve just three months of forbearance and extensions are rare. If a landlord with a mortgage loan has difficulties making monthly payments, there are big chances he defaults and faces foreclosure.

In today’s sanitary and economic conditions, owning tenants-occupied property is one of the hardest things to do. Many people have lost their jobs, businesses, and the ability to earn money. In Portland, the demonstrations and thousands of protesters have destroyed the beauty and peace of one of the most beautiful cities in America.

If conditions remain the same, small landlords could not keep their rental properties. Foreclosures and abandoned properties will abound in the Portland and Oregon’s real estate market.

Some landlords are looking for other solutions to avoid future headaches. Many have contacted us to inquire about our home buying process. We gladly have helped some of them during November and this December 2020.

Landlord Without a Mortgage Forbearance Plan

Conventional mortgage loans are those non-federally-backed. Typically, these loans require special treatment from lenders to qualify for a mortgage forbearance plan. In many cases, lenders reject them without any explanation.

Mr. Frankie Small came to our offices in Lake Oswego to get information about our home buying program. He owned a well-located rental property in Bethany. His tenant a restaurant manager of one of the most visited restaurants in downtown Portland lost his job. After the first Oregon lockdown order, the restaurant reopened to sell to go only. With a few employees, his tenant was able to sustain the restaurant business at flote. The place was just hanging there until a Saturday night, when violent demonstrators broke the restaurant doors, looted, and burned down the building.

By August, Mr. Small’s tenant couldn’t pay the rent, since that day for him has been near to impossible to get another job in the restaurant industry. Anticipating the difficulties ahead, Frankie Small called his lender to ask for a mortgage forbearance plan. After a prolonged interchanging of emails and phone calls, he was notified that his mortgage loan did not qualify for a forbearance.

Ending October, Better Off Home Buyers bought Mr. Small’s rental house. The house purchase paperwork was fast and clear as usual. Also, we included Mr. Small’s tenant needs. It is important for us that everyone involved in the sale-purchase transaction be a hundred percent satisfied.

Better Off Home Buyers Is The Solution.

2020 is a year to forget or to recall forever. The COVID-19 has been the start of changes that will remain in our lives for many decades to come. To eradicate the virus we had compromised the economy, our families, and the traditional way of living in our country.

We Americans are well known as hard-working people. Any immigrant that steps on our soil fall in love with our traditions, and soon becomes one of us. A free human being pursuing happiness and the American Dream.

All dreams have a price to be paid. Sometimes circumstances act out of people’s control, but that is part of life. The key to success is not to give up. If one fails, just get up, shake it up, and hit the road again. The goal is just a few steps ahead!

Nationwide we are struggling with the pandemic. Many lives are gone forever, and many more will be gone until a vaccine can defeat this mortal virus.

In the meantime, we must move on, we must take precautions and follow the recommendations of the authorities to prevent the virus from spreading. Unemployment has reached record levels, people have lost their jobs and are struggling to meet their basic needs. When the situation gets most difficult is when the head has to be colder.

Every problem has its solution. In the area we work every day, we have contact with a lot of people that are going through difficult moments. Nobody was expecting a pandemic and its associated negative aspects. There is no doubt 2020 has been a different year, for hundreds of thousands, the personal economy is a problem growing bigger and bigger.

The CARES Act does not provide protection to all homeowners and small landlords. Those with non-federal backed mortgages have to go under more complex requirements to be mortgage forbearance approved. Many of them just get a rejection for an answer.

The small landlords and homeowners who are having a hard time keeping their properties are considering to sell their houses. According to their testimonials, they couldn’t sell their homes throughout the regular real estate market.

To sell a property on the real estate market, it has to be issue-free, otherwise, no real estate agent would accept it. Many people need to sell their houses or their rental houses because the crisis pushes them to do so. Lack of income is affecting more people in Oregon and the United States. The government and the health authorities force us to an imminent closure in December and January. Citizens must be aware that drastic measures must be taken to end this coronavirus virus.

Small landlords and homeowners are permanently contacting us. They want to find out more about our criteria to buy properties. We have one simple answer to their questions, “Better Off Home Buyers buys your home AS-IS.”

Some homeowners are behind payments, others have a mortgage forbearance plan, pre-foreclosure, or a foreclosure process. Many small landlords with only one rental property haven’t collect rent payments for several months. We are a professional home buying company with years of experience purchasing properties in Portland and across the nation.

Contacting us is easy, just fill out the information form on this page or dial directly (503) 212-9641. We will contact you back in less than 24 hours. Then, we will schedule an appointment to visit your property. Visiting your house wouldn’t take more than 30 minutes. We’ll wear a mask, gloves, and shoe cover, we are committed to avoiding the coronavirus from spreading.

The selling-purchase process takes about 7, sometimes a few days more, sometimes a few days less. Every transaction is different. Our home purchase process is fast, transparent, easy to understand.

For more information please contact us. We are happy to help you.

También hablamos español.